Get the free sr 17 form

Show details

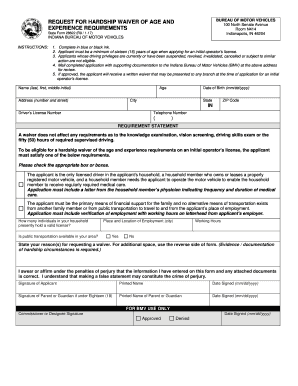

FORM SR-17 See Rule 41(2) Form of application for Temporary Registration of Motor Vehicle To, The Registering / Prescribed Authority ............................................................ 1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sr17 form

Edit your indiana hardship license application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your get create make and sign sr17 form indiana hardship license application form form online text sr 17 form sr17 form indiana hardship license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit who is required to file hardship license should file a hardship license application form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it is important to note that the equivalent authority for accurate and up to date information. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sr17 forms

How to fill out IN SR-17

01

Begin by gathering all required personal information, including your name, address, and Social Security number.

02

Obtain the IN SR-17 form from the appropriate authority or download it from the official website.

03

Carefully read the instructions provided at the top of the form to understand the requirements.

04

Fill out the personal information section, ensuring accuracy in every detail.

05

Provide any necessary financial information as requested in the relevant sections.

06

Review the completed form for completeness and correctness.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either by mail or electronically, depending on the submission guidelines.

Who needs IN SR-17?

01

Individuals applying for a specific program or benefit that requires the IN SR-17 form.

02

Residents of Indiana who need to report financial information or status for regulatory purposes.

Fill

what is sr17

: Try Risk Free

People Also Ask about hardship license form

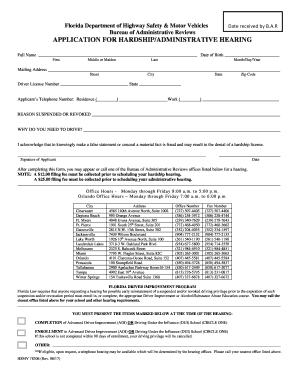

How much does it cost for a hardship license in Florida?

How Much Is a Hardship License in Florida? The fee to file for a hardship license is $12.00, but you may be required to pay additional fees depending on the specific factors surrounding your case, such as why your license was suspended and the type of DUI conviction you have.

What documents do I need to get a hardship license in Florida?

In most cases when applying for a Florida hardship license you must show proof of enrollment in a state-approved Florida Advanced Driver Improvement (ADI) course. This proof of enrollment usually takes the form of a printed enrollment letter.

What is required to get a hardship license in Tennessee?

Eligibility Applicant must be a Tennessee resident and at least 14 years old. For a first-time license, an applicant must be in compliance with the Compulsory School Attendance and Satisfactory Progress Law. Applicants for a Hardship License must meet the same eligibility standards for Class D License.

What do you need to get a hardship license in FL?

Florida Hardship License Requirements Step 1 - Register for a 12-hour Florida ADI course and get your enrollment certificate. Step 2 - Fill out an application for a hardship hearing. Step 3 - Take both of these items to your local Administrative Reviews Office. Step 4 - Pay the related fees.

Can I apply for a Florida hardship license online?

Most people opt for the more convenient option and sign up for an online ADI course. As long as you're enrolled in a course you should be able to apply for a hardship license no matter whether it's online or in-person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify hardship license florida without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your stupid site pdffiller com site blog pdffiller com into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit how to get hardship license straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sr 17 forms.

How do I complete hardship license indiana on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your indiana hardship license. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IN SR-17?

IN SR-17 is a specific tax form used to report certain income and deductions for individuals or entities in Indiana.

Who is required to file IN SR-17?

Individuals or entities with certain types of income that are subject to Indiana state tax are required to file IN SR-17.

How to fill out IN SR-17?

To fill out IN SR-17, gather all necessary financial information, complete the form following the instructions provided, and ensure all calculations are accurate before submitting.

What is the purpose of IN SR-17?

The purpose of IN SR-17 is to report income and claim deductions or credits for tax purposes in the state of Indiana.

What information must be reported on IN SR-17?

Information that must be reported on IN SR-17 includes income details, deductions, tax credits, and other relevant financial information needed for state tax assessment.

Fill out your sr 17 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Form 28622 is not the form you're looking for?Search for another form here.

Keywords relevant to sr form filling

Related to sr form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.